American Express Gold: one card for all ages

one of the most popular on the Amex circuit, which allows you to add it to your wallet for free without having to pay any fees [...]

Some of the offers included in this article may have expired, to find out what offers are active right now click here

The American Express Gold Card è one of the most popular on the Amex circuit, which allows people to add it to their wallets for free without having to pay any fees for the first year and, by meeting a certain threshold, the second year as well. The amount involved is not the lowest but is commensurate with the prestige of the credit card, which also requires a higher annual gross income than other Group proposals.

In this article:

Who should apply for the Gold Card

The American Express Gold Card is one of the best solutions on the market for those looking for a second card. Its is an everyday use. It is not one of those cards that are over time forgotten inside one's wallet.

There is, unfortunately, a tendency in Italy to regard credit cards as an item that can be used only in the case of very expensive purchases that require a deferral to the following month. Nothing could be more wrong. The many advantages offered by this card make it essential for young professionals with a few years of experience (and therefore earnings) behind them. The same can be said for fathers and mothers of families, who want to pull in their monthly expenses, trying to get something in return for the money paid for bills, groceries and more.

Why call it, therefore, an excellent second paper? For the simple fact that it may not be accepted just anywhere. In Italy, digital payment may still be a taboo, especially in certain commercial areas. The guaranteed bonuses, however, will easily make it possible to forget this obstacle, which will hopefully one day disappear altogether in our country.

American Express Gold Card: benefits and services

By activating the American Express Gold Card, you get theautomatic access to the Club Membership Rewards, where you can accumulate reward points for every euro you spend with your credit card. Once certain thresholds are reached, you can choose rewards or discounts on your annual fee. One thousand points is equivalent to four euros.

A variety of benefits can be taken advantage of for travel, special events or, why not, everyday life. It is good to know that purchases are protected by a anti-fraud protection and a purchase protection. In the first case, protection against illicit use of the card is provided; in the second, a protection for 90 days For purchases made up to 2,600 euros.

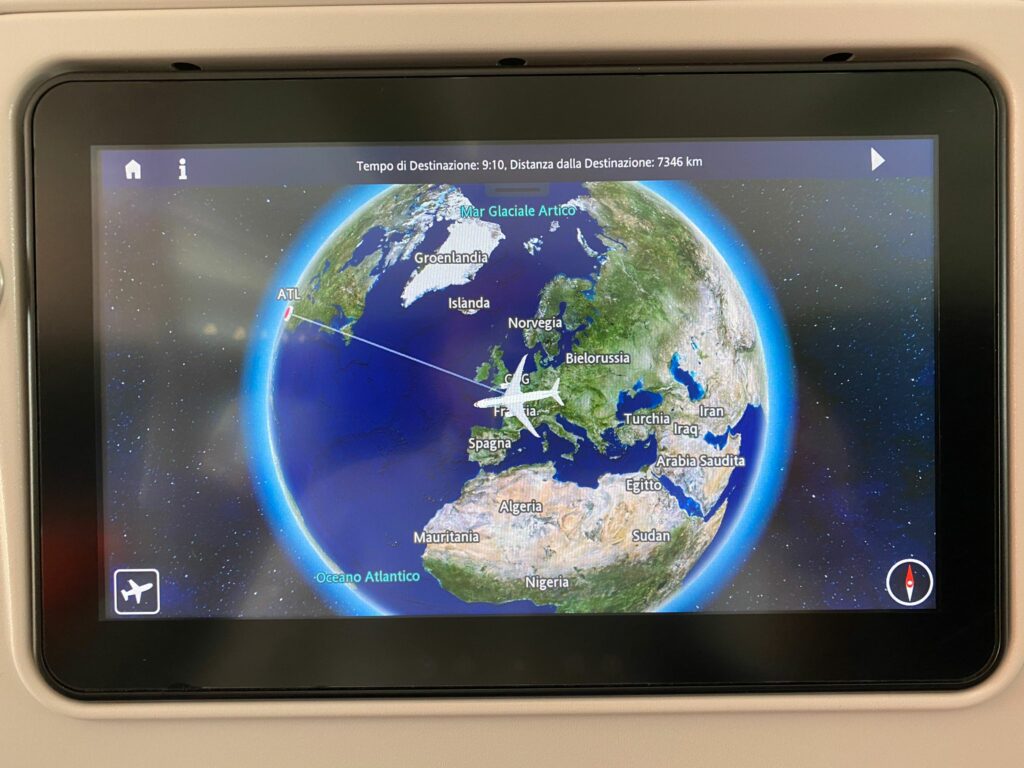

A rich travel package is featured, which includes a priority pass. Membership is free and provides access to over 1,300 VIP Lounge airports around the world. By booking through the Amex website for a stay at one of the program's facilities. The Hotel Collection, you will get a maximum credit of $100 for ancillary hotel services, such as spas, restaurants and bars. This is in addition to a free room upgrade, if available at check-in.

Benefits also for car rental with Hertz e Avis. In the first case you get a discount of 10%, plus other benefits. In the second, however, the discount is 20% in Italy and 15% in the rest of the world, but there are other bonuses as well. The most important extra when traveling is the contingency and accident insurance, with coverage of up to $3,000 in medical, legal and assistance expenses.

As for everyday life and events, two tickets will be available for purchase each week at the The Space cinema at a price of 8 euros. There are also 2×1 offers for a variety of events. Many times it is possible to purchase tickets in advance thanks to the program American Express presales.

American Express Gold Card: the offer for new customers

The application for the American Express Gold Card is totally free of charge the first year. In addition, spending €500 in the first 3 months will get €150 immediate cashback on the card account.

How to Apply for the American Express Gold Card

Applying for the American Express Gold Card is easy and free. The procedure can be carried out in a few minutes through the official Amex website. Operation executable only by citizens of legal age, resident in Italy and in possession of an Italian correspondence address.

The credit card must be connected to an active bank account in order to make month-to-month balance payments. The account must belong to the SEPA circuit, and the reference IBAN cannot correspond to a prepaid card. As for the applicant's gross annual income, it must not be less than 25,000.

Some of the offers included in this article may have expired, to find out what offers are active right now click here

- 250€ discount against spending 5K in 6 months

- Free fee the first year, 20€/month from the second year

- 250€ cashback if you spend €3,000 in the first 12 months

- Travel voucher: $50 for your travels each year to spend at americanexpress.co.uk/travel

- Priority PassTM: Gold Card gives you free membership in the Priority Pass Program and two free admissions each year, both for you or you and a companion

- Travel inconvenience and accident insurance: you will be protected in case of delayed baggage delivery or flight delay or cancellation

- Purchase Protection: protection for 90 days up to €2,600 on purchases made with Card (excluding certain merchandise categories), in case of theft or damage to the goods