Open Selfy account treat yourself to a Chromebook and start collecting double MR points

If you are looking for a new checking account, we recommend the. We can say this without fear of contradiction, it is [...]

Some of the offers included in this article may have expired, to find out what offers are active right now click here

If you are looking for a new checking account, we recommend theonline Selfy. We can say this without fear of contradiction, is probably the ideal account for anyone who wants to maximize the reward travel points collection.

In this article:

Operation

All new customers who will openA Selfy checking account by July 31, 2021 and who, from the date of opening the current account and within the following three months, will perform at least one of the following behaviors:

- Crediting to current account of emoluments/pension in the manner provided by Banca Mediolanum;

- Credit to bank account of recurring wire transfers or recurring bank checks of at least €800 each month in the three months;

- Debit on the account of at least two utilities (both utilities must produce at least one charge in the 3 months) plus at least one of the following:

(a) Mortgage holder;

(b) Overdraft holder;

(c) Charges due to the use of credit and/or debit card, amounting to >€3,000 - Having applied for and been issued a Mediolanum Credit Card or Mediolanum Credit Card Prestige;

They will receive a Samsung ChromeBook Go 14″ (4 + 64) WiFi

How to open the account

Open Selfy Account is really simple, also because you can do everything completely online.

You will only need to have available:

- a valid identification document

- your tax code

- your smartphone

- a personal e-mail address

And only with a video call you will be able to make the identification, thus activating the online checking account of Banca Mediolanum.

Alternatively, you can also make a wire transfer if you prefer to use another quick and convenient method.

Why is it the ideal account for the reward travel world?

Banca Mediolanum is (probably) the only bank in Italy that is able to issue "personalized" American Express credit cards and to propose offers that are different from those that are normally available to customers who turn generically to the AmEx site. All the people who aim to maximizing the benefits of reward travel should choose this option: it is the best in Italy in terms of earning points per euro spent.

For example, you can apply for an American Express Platinum and pay the fee in half for the first year or totally discount the €720 annual fee if you spend a minimum of €25k with the card in the previous 12 months.

But the absolutely most interesting card is the American Express Gold, which is also the only one that has a proprietary design.

The current offer includes: free fee the first year, from the 2nd year €150. If you spend at least €1,000 with Carta within 3 months of issuance, you will receive immediate cashback of €200.

The good news is not over, as this is compounded by the fact that. every year you will receive 20k Membership Rewards points extra, if you have spent at least 10k euros in the previous 12 months. Of course, these proprietary benefits of Banca Mediolanum are in addition to all the classic benefits of American Express cardholders.

How to double MR points thanks to the Mediolanum For You program

The real uniqueness is that Banca Mediolanum has its own loyalty program. which allows customers to accumulate points by using products offered by the bank, through daily spending and through the "introduce a friend" promotion.

Here it is Mediolanum American Express Gold cardholders will earn one Medionalum For You point for every euro spent with the card, with no limit. And points can be transferred into MR points at a rate of 1:1, effectively allowing you to earn 2 MR points for every euro spent. Alternatively, they can also be transferred to the Alitalia Millemiglia program, but with a worse rate of 2:1, this means that it is still worthwhile to switch from MFY to MR and from MR to MM since the conversion is 1:1.

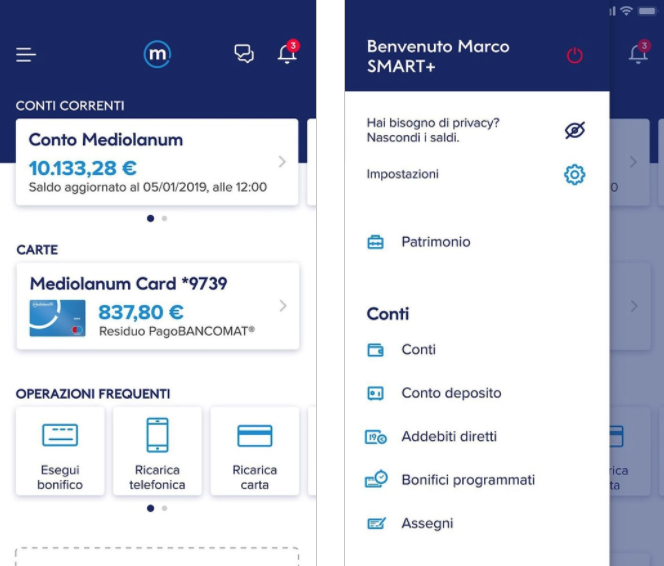

What is Selfy

A comprehensive offer, which can be activated with the opening of Selfy Account, which allows people to manage their daily banking, how to get a loan in real time, arrange an instant transfer, carry out trading and fund purchase transactions, in total freedom and autonomy. All this is guaranteed by the solidity of Banca Mediolanum, one of the most reliable banking institutions in the market.

It is a comprehensive, digital current account dedicated to all customers who want to have the freedom to try Banca Mediolanum by independently choosing services and building the bank to their size and measure. Selfy is fully digitally subscribable and manageable through web and app. It is also completely free for everyone for the first year. For customers up to 30 years of age, it continues to be at zero cost, while for others, the fixed cost is 45 euros annually, but it can be reduced to zero by using products offered by the bank.

What Selfy offers

Open the Mediolanum app and get started: dispose of payments, make instant transfers, pay F24s and bills with a photo and operate on your investments. In addition, you can check the movements of your cards at any time, installment payments and, in case of emergency block them, for 48 hours.

Cash and check deposit - More "traditional" transactions, such as depositing cash or checks into the checking account, are secured through Intesa Sanpaolo and Poste Italiane ATMs (while cash withdrawals are enabled at ATMs at any bank).

To make a deposit, simply enter the ATM, type in the secret code, select the option on the display, and insert the bills or check in the space provided. The balance will be updated within a few business days.

The account also makes available to you:

- one free debit card

- free withdrawals In ATMs: withdraw your money without any limit in the Euro area

ATM Pay and Plick - Both allow instant money exchange and payment from the app. The former requires the transfer recipient to have the same service enabled, the latter requires no activation or additional accounts.

With Plick, you only need to have the recipient's contact (cell phone number or e-mail address) in your smartphone address book. The beneficiary of the transfer receives a link via SMS or e-mail, through which he or she can cash directly into his or her bank account.

Paying with your smartphone in the store - The phone can also be used in the store in place of a physical card, for POS terminal payments.

After registering the ATM in the Google Pay (Android), Apple Pay (iOS), Samsung Pay or Garmin Pay apps, to pay with your smartphone you will simply authorize the transaction via fingerprint or facial recognition.

How to earn bonus points

We have said it many times, if you are in the world of reward travel, bonuses should be taken advantage of all of them. Crediting your paycheck brings 700 bonus points, domiciling a bill 50 points, and on and on for many other small daily transactions. It is also possible to earn a lot of points by introducing a friend: it can generate 6 to 10 bonus MFY points.

All points that can be transferred true MR collection at the rate of 1:1.

In conclusion

Thanks to Operation Selfy you get in touch with one of the most solid banks in Italy. A digital account that has nothing to envy from other experiences and allows free withdrawals from any ATM in Italy and the Euro Zone, as well as free domestic and European transfers. Not to mention that it gives access to the American Express world in a unique way: with bonuses and benefits unattainable through traditional cards.

Some of the offers included in this article may have expired, to find out what offers are active right now click here

- 12,000 Mileage Registration Bonus

- Collect miles WITH EACH PURCHASE

- Your miles with no expiration*

- No fees for ATM withdrawals and foreign purchases

- Without having to change banks

- Autonomous card activation

- Multi-function mobile application

- Free travel insurance

- Free credit for up to 7 weeks

- Contactless Payment

- Mastercard® SecureCode