How are low-cost airlines preparing for summer 2021?

In the short term few people would trust booking a trip, between closures, partial reopenings, health passports and restrictions not [...]

In the short term few would trust booking a trip, between closures, partial reopenings, health passports And restrictions you don't know where to hit your head anymore. Here's gritting your teeth a little more and already thinking about thesummer 2021 doesn't seem like a bad idea.

In this article:

Even low-cost airlines think so and are already preparing their own moves to avoid throwing away another tourist season and dealing the death blow to an industry already battered by the health crisis.

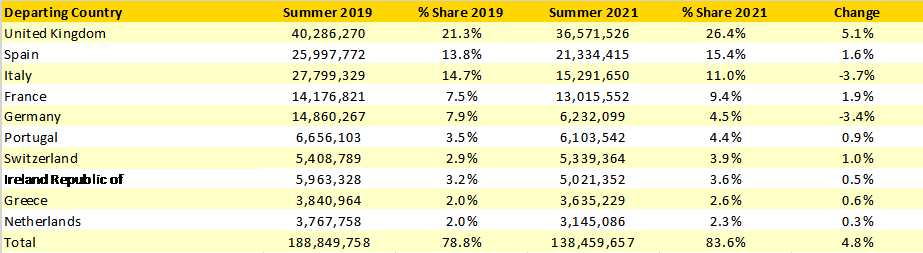

Analyzing the data Of Europe's three largest low-cost airlines, viz. easyJet, Ryanair e Wizz Air, it is inferred that the total capacity they aim to reach for this summer is 138.4 million places, 50 million less than in summer 2019.

Brexit? Not for tourism

After years of bargaining, the United Kingdom has left the European Union, but that does not scare the tourism industry. In fact, the three carriers would seem to be planning to increase the volume of operations in the UK, the scheduled posts are well 36.5 million, a threshold close to that of 2019.

Perhaps it will be the confidence of the British company AstraZeneca, that is producing the vaccine, or the adoption of the Health Passport, The fact remains that the United Kingdom looks like a horse to bet on for this summer.

Bad news, on the other hand, for Italy e Germany, the three low-cost airlines have decided to cut a good chunk of their seats, with Germany suffering a 60% drop compared to 2019, while Italy will have a good package of 15 million of places though as many as 12 million fewer than in 2019.

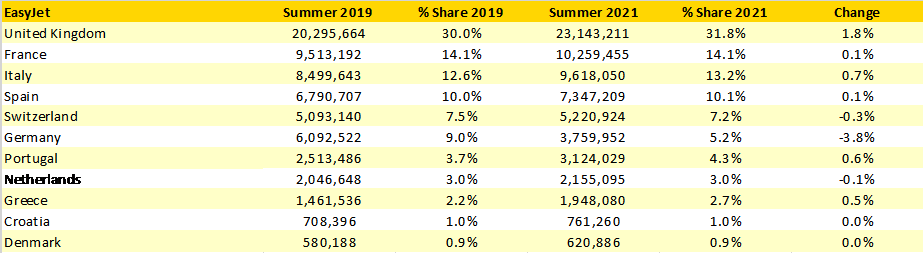

EasyJet focuses on the UK

Despite the closure of three operating bases during the summer of 2019, easyJet will continue to maintain a substantial presence in UK, with almost a third of its capacity. The goal is to strengthen the airport's London Gatwick with a 17% increase in volume over 2019.

All this is at the expense of Germany, where easyJet will cut almost by the 40% volumes. In contrast, Portugal and Greece, being high-growth markets, partly because of the affordability of travel, will receive a increase Of half a million additional seats.

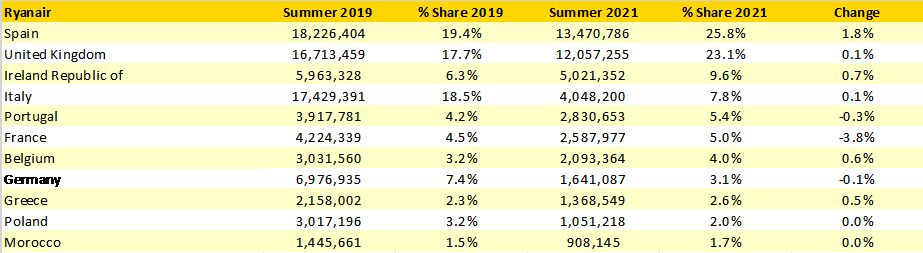

Ryanair treads lightly

Ryanair's approach, on the other hand, is more cautious, Irish airline has planned about 52.2 million seats for summer 2021, nearly the half compared to summer 2019. It would appear that Ryanair wants to wait for the market to respond better in order to possibly renegotiate with airports.

Almost half of the current volume focuses on flights premises, between the United Kingdom and Ireland, at the expense of, for example, Italy, which sees a cut of more than 10 million places compared to 2019.

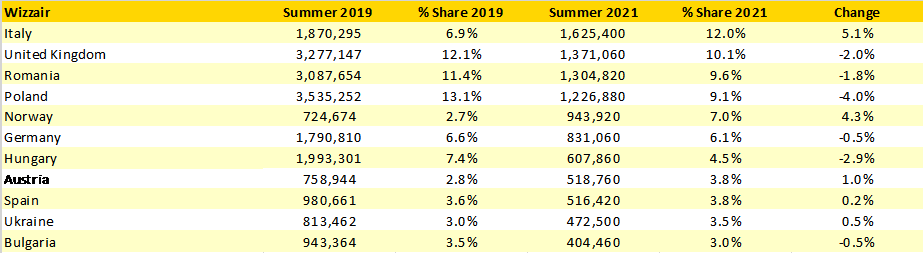

Wizz Air aims for the boot

Although Wizz Air has planned half as many seats as in 2019, a large chunk (about 13.5 million) will be devoted precisely to theItaly that will make it the No. 1 market for summer 2021.

Wizz Air is also strengthening its presence in Norway, with a rapid increase in capacity in the latter half of 2020, when it took advantage of the demise of the flag carrier, Norwegian. Italy was not much affected by the change, in fact the cut was only 200,000 seats compared to 2019.

Strongest markets for summer 2021

Low-cost airlines are extremely flexible and it is very likely that these estimates will change over the months. In any case, from this initial analysis, we can see that Spain, Greece e Portugal are likely to be the strongest markets for summer 2021.

It will be affected by Italy and Germany, which are nonetheless holding their own and winning satisfactory volumes; it cannot be ruled out that market conditions may change and Italy will be added extra quotas.

- 6,000 Mile Registration Bonus

- Collect miles WITH EACH PURCHASE

- Your miles with no expiration*

- No fees for ATM withdrawals and foreign purchases

- Without having to change banks

- Autonomous card activation

- Multi-function mobile application

- Free travel insurance

- Free credit for up to 7 weeks

- Contactless Payment

- Mastercard® SecureCode