Mooncard has landed in Italy, now you can accumulate Flying Blue points with business expenses

We had already talked about Mooncard in January 2021, the French financial startup is in the world of credit cards 2.0 [...]

We had already talked about Mooncard in January 2021., the French financial startup is in the world of credit cards 2.0 like the various Revolut, N26 and the like. In this case it is a dedicated solution for companies Of all sizes for managing employee expenses.

In this article:

Since the beginning of January, it has also opened for the Italian market and we at TFC couldn't help but request it immediately, if only for the rich welcome bonus: 21 thousand Flying Blue points. In fact Is the only product available for the Italian market which allows you to Directly turn expenses into Air France and KLM frequent flyer points, as was the case in Italy with American Express Alitalia credit cards, or the disappearances British Airways credit cards issued by Agos.

Mooncard's proposal for Italy

If in France this company has been operating since 2016, in Italy is really a start-up, and you can tell this from so many aspects. They are definitely not as organized as the big operators or even similar companies that have been in our market for much longer.

As mentioned, this is a paper designed for the world of vat holders and more structured businesses. The big advantage is that it participates in the Visa circuit, which effectively makes this card usable anywhere, both online and in physical stores, like a traditional credit card.

There are three types of cards: mobility, corporate and premium.

- Mobility is designed primarily to manage expenses related to travel: gasoline, parking, tolls, and charging points for electric cars. For every euro spent allows you to accumulate 1 FB point

- Corporate is a credit card at 100% valid anywhere a Visa is accepted. Also this one for each euro spent allows you to accumulate 1 FB point

- Premium is the most exclusive of the cards and the one with the most content, the only one that Allows you to accumulate 1.5 FB points for every euro spent.

Which paper to choose

It depends a lot on the needs and size of the companies. Certainly the mobility card is ideal for those who need to give employees a means of payment to pay for travel. Accepted at all gas stations, it is perfect for solving the fuel payment problem.

The other two solutions are more comparable to corporate credit cards, with the addition of total control over usage typical of these 2.0 cards.

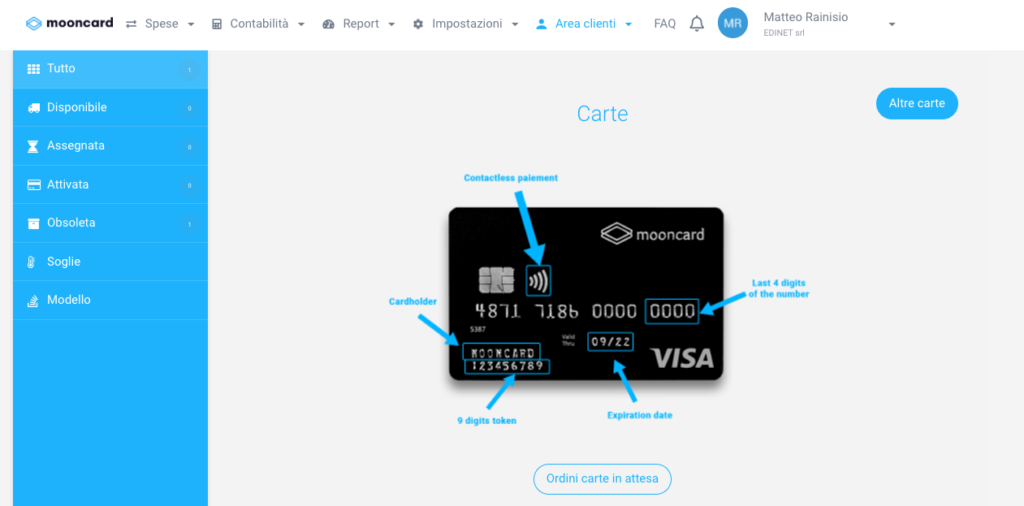

Through the personal area, it is possible to manage all the configurations of individual cards: enable and disable services, set usage limits, decide which days of the week you can use them. The possibilities are endless, or almost endless. That's the beauty of a 2.0 product.

How they work

They are credit cards, but they are like reloadable cards: each company decides how much to load onto the account, and individual cards can spend as long as there is availability. By doing this, it is possible to keep track of all aspects of the cards and their use.

21 thousand FB points welcome bonus

I chose the premium option, attracted by the rich welcome bonus: 21 thousand Flying Blue points are quite for a prize ticket to fly with Air France or KLM to New York or Dubai.

Why I chose Premium

I have been searching for years for my company to find an "alternative" corporate credit card to American Express, Plan B in the increasingly rare cases where Amex are not accepted. Of course, over the years I have used the classic Nexi card, but I have always been waiting for a card that would allow me to accumulate Points to be turned into reward travel.

This card is not only perfect for that by being a Visa, but mostly because allows me to turn every euro spent into 1.5 Flying Blue points, also in those categories of expenditures Where other papers do not allow accumulation. Then there is an additional immense benefit: thanks to the partnership between Air France and Mooncard, the accumulation of FB points allows the validity of the points to be postponed indefinitely, which instead normally expire after 24 months of inactivity.

The benefits included in the premium card:

- 7/24 personal assistant. A personal assistant who handles all your daily life needs: professional and personal. Whether you need to arrange for your suit to be delivered to the ironing room, to find the last two seats at a concert that has been sold out for months, or to find a plumber available at your home on the same day-your assistant takes care of everything.

- An Allianz Premium insurance for travel and portable items. In addition, with Mooncard Corporate insurances, you are insured for portable items (phone, computer, etc.), purchase of goods (theft or damage in the last 15 days), extended builders warranty (+24 months), delay of means of transportation (waiting, modification or repurchase expenses)

- A free travel agency at your disposal. Need to plan a business or personal trip? Your personal assistant takes care of everything from tickets to on-site activities. You won't be asked for commissions, and the personal assistant takes care of finding the best trip based on your needs. As far as possible, he or she will be able to submit or obtain preferential offers.

The card also gives the status Platinum with the Sixt rental loyalty program and access to the network of Dragonpass lounge.

In conclusion

Now I'm going to start testing this paper and to see how it performs, how the management system works, and how the system of crediting miles with daily spending works. The hope is that other credit card operators will also decide to enter this world.

- 6,000 Mile Registration Bonus

- Collect miles WITH EACH PURCHASE

- Your miles with no expiration*

- No fees for ATM withdrawals and foreign purchases

- Without having to change banks

- Autonomous card activation

- Multi-function mobile application

- Free travel insurance

- Free credit for up to 7 weeks

- Contactless Payment

- Mastercard® SecureCode