Insurance is expensive, but traveling without it could cost you: how to get it for free with American Express

I recently went to Tokyo and was struck, as soon as I landed, by the advertisement warning tourists that any unforeseen, [...]

I recently went to Tokyo and was struck, as soon as I disembarked, by the advertisements warning tourists that any unforeseen event, even the smallest, could cost you dearly if you are not protected.

Why traveling without insurance is a risk

In this article:

The covid has taught that being "protected" when traveling, away from home and outside the golden borders of the European Union, allows one to deal with any unforeseen event without major worries. I'm not talking about a canceled or delayed flight, but any kind of problem that might happen before and during the trip, both to those who are on vacation and those who stay at home.

Having to return home suddenly, having a health problem to being involved in a small accident such as getting hit by a cyclist. What can happen during a trip is a matter of fate, in 99.99% of cases nothing ever happens, but if it does happen then it is better to be prepared

The example of Japan, a small accident 50 thousand euro bill to pay

It does not matter whether one is wrong or right, what is certain is that if we are outside the European Union, and we have an unforeseen health problem we will have to pay the doctor's bill, the ambulance bill, the hospital bill, and even the ticket home if we missed the scheduled flight.

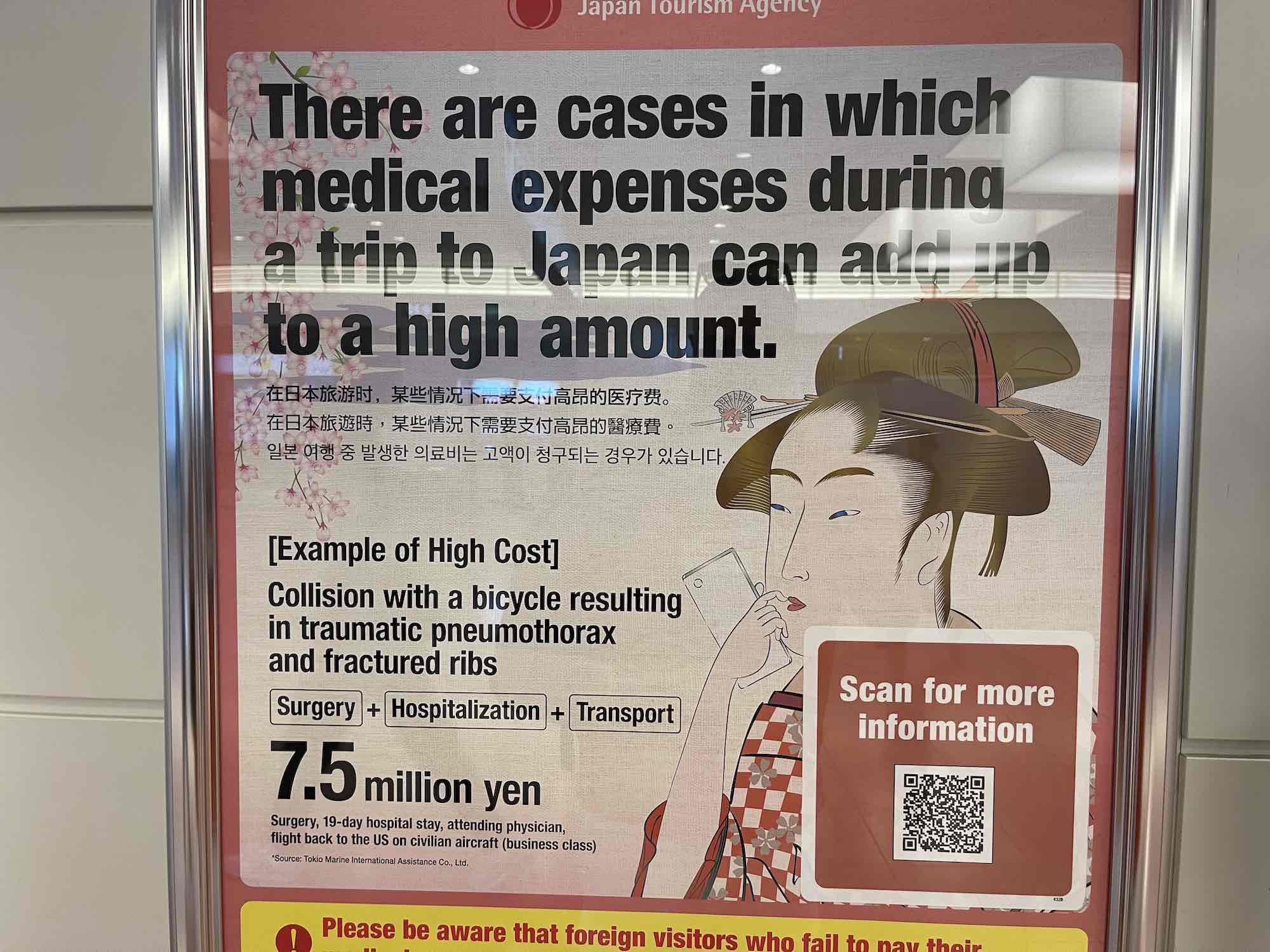

Around the Tokyo airport there are several examples of the bills one will have to pay in case of an unforeseen incident. The example above is about a minor accident where the unfortunate tourist gets hit by a cyclist on the streets of Tokyo, frankly I don't recall ever seeing a cyclist in Tokyo, but that's a different matter.

Diagnosis after traumatic event leads to an outstanding bill of 7.5 million yen, at the current exchange rate just under 50k euros. This amount is arrived at with the intervention of health care providers, hospitalization, operation, hospital stay and the ticket home.

If you are unable to pay the bill, assuming you are still able to leave the country, you will not be able to set foot in the Rising Sun again until you have paid the debt (with interest).

Of course, this is not only true for Japan, but from the U.S. to the UAE there is no place in the world where in an emergency you will be treated for free.

Better travel insurance is "free" for Amex Platinum holders

I have written many articles explaining how my platinum has saved me from all kinds of problems. Small damages to the rented car, the suitcase that was lost at the airport, flights canceled due to health problems, and much more. As many readers have realized having this card in my wallet. means to leave with peace of mind and save a lot of money in travel.

If the monthly fee for American Express Platinum can be frightening. are 60€ per month, it is easy to see that even with just one family trip across the ocean can amortize the expense as it is not necessary to take out ad hoc insurance. Platinum's coverages are among the best on the market and sufficient to pay for any contingency, even the most dramatic.

No matter if you travel economy or first class, having this card in your wallet is better than having BOTs in the bank.

The pandemic has taught us that health care expenses abroad, the cost of tickets for new bookings, and forced stays away from home can be very expensive, for me the risk is not worth the candle. There are countries, such as the U.S., where it is not mandatory to show proof of insurance in case of inconvenience. Others, however, require the certificate. In any case. Amex Platinum is more than enough and does not require you to do anything but be a holder.

Insurance is always ready, it should not be activated and nothing should be communicated to anyone.

Here are the cases in which insurance can be brought in:

- Cancellation, missed or delayed departure

- Trip interruption

- Medical care and expenses

- Personal effects, documents and money

- Travel inconveniences

- Travel accidents

- Car Rental

- Purchase protection

As you can see, all the different possibilities are present: a strike that stalls abroad, a piece of luggage that does not arrive at its destination, a scratch on the rental car to a slip while walking along the Great Wall.

Some examples of ceilings and coverages included:

Medical treatment: up to a maximum amount of €5,000,000 for medical, surgical and hospital expenses necessary as a result of your illness or injury during the Trip.

Car rental: The benefit for the damaging event will be guaranteed regardless of whether or not the Insured is responsible for the event, Up to a maximum of €75,000 per event.

Delayed baggage delivery. Up to €400 per person if your checked baggage has not been delivered to you within 4 hours of your arrival at your destination airport. Figure that doubles in case the suitcase arrives after 48h.

The Insured will receive an indemnity of € 75,000 if, during his/her Trip, he/she suffers a physical injury and, within 365 days from the date of the accident, the following results from it: a) death; b) complete and permanent loss of the use of any limb; c) total and irreparable loss of sight, speech or hearing; d) permanent total disability.

These are just a few examples of covers, the full policy can be viewed On the Amex website.

In conclusion

Having this card gives all kinds of benefits, allows you not to pay the breakfast in hotels around the world, saves money through offers and discounts and Gives points to turn into unique experiences.

However, it is the travel insurance that is why I am happy every month to pay for this card, Because it covers me and my whole family, every day all over the world.

- 150,000 memebership rewards points by spending 6,000 in the first Y

- 300 € cashback at over 1400 restaurants

- automatic enrollment in the Membership Rewards Club

- Fast Track: prioritizing security checks at major Italian airports

- Travel voucher: €150 for your travels each year

- Dedicated travel service

- Free membership in the Prestige level of the Priority Pass Program

- Membership in hotel and car rental chain loyalty programs

- Global travel insurance

- Presales for advance purchase of tickets to top concerts

- Purchase Protection: 90-day protection of up to €6,000 on purchases made with Card