Gold Vs Platinum, which is the best American Express for traveling

We dispel the myth that American Express cards are only for the "rich" and especially that they are not accepted by merchants. [...]

Let's dispel the legend that American Express cards are only for the "rich" and especially that they are not accepted by merchants.

In this article:

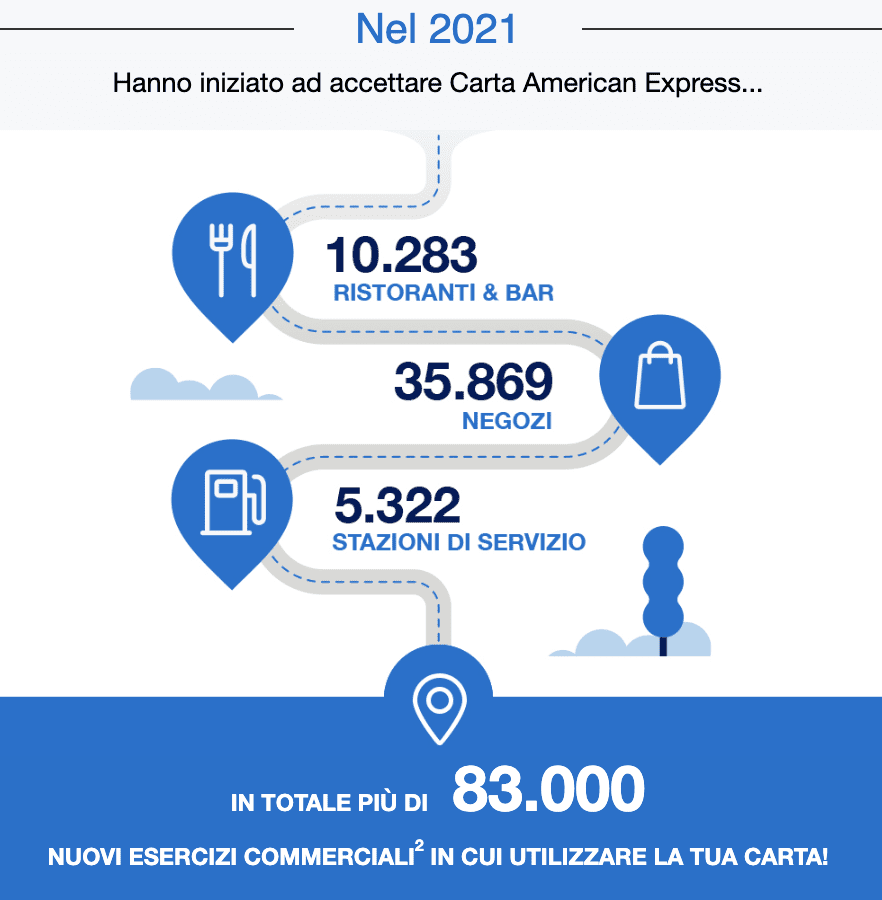

In the past year alone, there have been More than 83 thousand businesses that have added Amex as one of their accepted cards. Many of these belong to the small business category and participate in promoting Shop Small that gives an instant discount of €25 in many stores.

In Italy, many credit cards offer themselves as travel companions, but without a doubt the two best cards available on the market, even in the absence of ITA Airways credit cards, are the American Express Gold and its older sister the American Express Platinum.

With this article we want to make a comparison between these two cards to help you identify which card is perfect for you.

Welcome offer

The welcome offer is nothing more than the prize that is offered to the new customer in exchange for signing up for the new credit card. There may be offers in Membership Rewards points, offers in benefits such as double points, and, as in this case, cashback offers that allow for amortization, if any, of the annual card fee.

American Express Platinum

Let's start with the most popular and content-rich, the first metal card to land in Italy is offered with a €60 monthly fee. To those who subscribe to this card by July 7. a cashback of €400 is offered, so more than half of the first year's fee.

American Express Gold

New Gold cardholders can take advantage of a double offer: the free annual fee for the first year and a cashback of €250 if you spend at least €4,000 within the first six months from when you activate the card.

In terms of the welcome gift then it is definitely more interesting one offered by the Gold card which adds up to the free fee (€14/month) in addition to the €250 cashback.

Membership points: accumulate and spend them

We have extensively explained what are Membership Points and how it is possible to accumulate hundreds of thousands, every year, without spending anything. Points that can then be Used to be converted into airline tickets, for free or with a few tens of euros.

With both of these cards you earn 1 MR point for each euro spent, but then there are so many promotions that allow you to accumulate bonus points. For example, the Amex travel site allows, right now, to Accumulate 10 points for every euro spent. But there are also other promotions that offer the holder discounts and bonus points with daily spending.

In this respect, therefore, the papers are equivalent and there are no differences whatsoever.

Benefits and advantages when traveling

These cards offer cardholders similar benefits, but of course with different values, benefits that justify the on average more expensive cost than traditional credit cards.

American Express Platinum

It doesn't matter if you travel in economy or first class, only Being a Platinum cardholder automatically makes the journey of the cardholder and his/her family more peaceful.

The list of benefits is very long, here are the main ones:

- 150€ annual voucher to spend on the Amex travel site. This voucher can be redeemed to book flights, rent cars or stay in hotels

- 120€ per year, divided into. 10€ month to pay for cab rides with Free Now in Italy

- Access to facilities Fine Hotels + Resorts giving away money to spend in the facilities booked and many other benefits

- Fast track at Italian airports and access to the airport lounges around the world

- Status and benefits in the loyalty programs of 4 hotel chains and in 4 rental companies

- A travel insurance among the most comprehensive on the Italian market, which also includes the car rental

- Almost all benefits double thanks to the card Free additional platinum

All these benefits serve to justify the monthly cost of 60€, a significant fee that thanks to the welcome offer and various benefits allows you to Zero out the cost of the card at least for the first year. It should be noted, however, that thanks to the many promos, ad example those for expenses in hotels, the cardholder can amortize the card fee each year.

American Express Gold Card

If you have never been a customer of American Express, this Is the perfect card to start with thanks to the fact that between the free fee for the first year and the welcome cashback offer, you can keep the card for almost 3 years without spending anything (the 14€ monthly fee from the second year can be amortized by the 250€ activation bonus).

The list of benefits is not as long as for the Platinum, but some pillars are there:

- 50€ annual voucher to spend on the Amex travel site. This voucher can be redeemed to book flights, rent cars or stay in hotels

- Priority Pass Which gives away two lounge admissions worldwide and discounted admissions from the third onward

- Cashback offers Dedicated on the app with lots of travel expenses

- A travel insurance base that covers inconveniences such as delayed flight or lost luggage

In this case it is obvious that the Platinum card offers the most comprehensive package, but it is also the one that costs 60€ per month. The choice between the two cards must therefore be weighed against the traveler's habits and planned trips. If, for example, one has in view a U.S. vacation, only the savings from travel insurance combined with the other offers will allow the annual card fee to be amortized and immediately start traveling better thanks to upgrades and free breakfasts.

- 150,000 memebership rewards points by spending 6,000 in the first Y

- 300 € cashback at over 1400 restaurants

- automatic enrollment in the Membership Rewards Club

- Fast Track: prioritizing security checks at major Italian airports

- Travel voucher: €150 for your travels each year

- Dedicated travel service

- Free membership in the Prestige level of the Priority Pass Program

- Membership in hotel and car rental chain loyalty programs

- Global travel insurance

- Presales for advance purchase of tickets to top concerts

- Purchase Protection: 90-day protection of up to €6,000 on purchases made with Card